GST Dispute Matter

A GST Dispute Matter arises when there is a disagreement between a taxpayer and the tax authorities regarding GST compliance, tax liability, input tax credit claims, classification of goods/services, or late filing penalties. Such disputes may be due to incorrect tax calculations, mismatches in GST returns, or departmental audits. Resolution typically involves responding to notices, filing appeals, or approaching the GST Appellate Authority or Tribunal. Proper documentation, legal consultation, and timely compliance are crucial to effectively handling GST disputes and avoiding penalties.

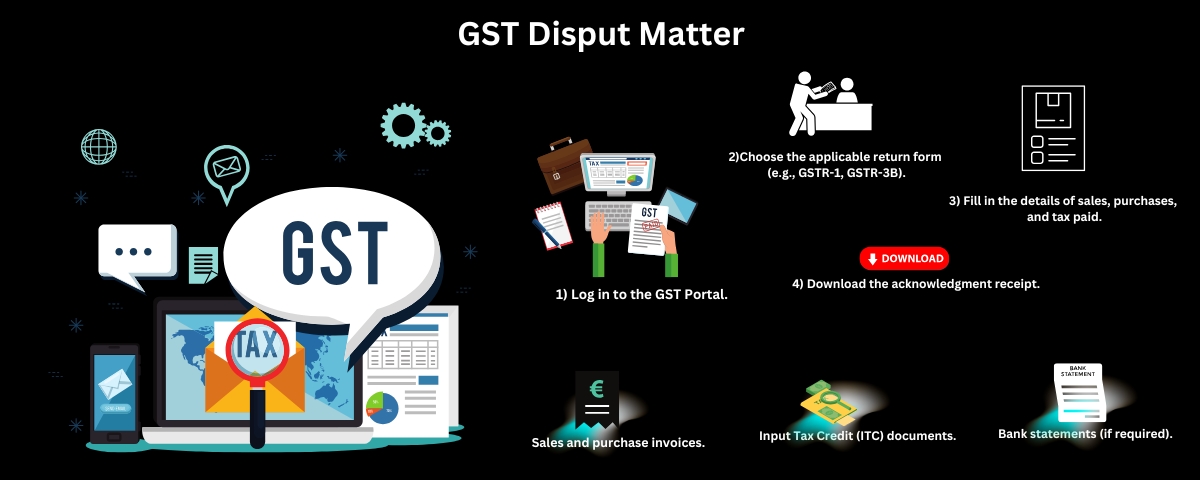

Required Documents:

- GSTIN.

- Sales and purchase invoices.

- Input Tax Credit (ITC) documents.

- Bank statements (if required).

Information:

- Returns must be filed monthly, quarterly, or annually based on the type of GST registration.

- Late filing attracts penalties.