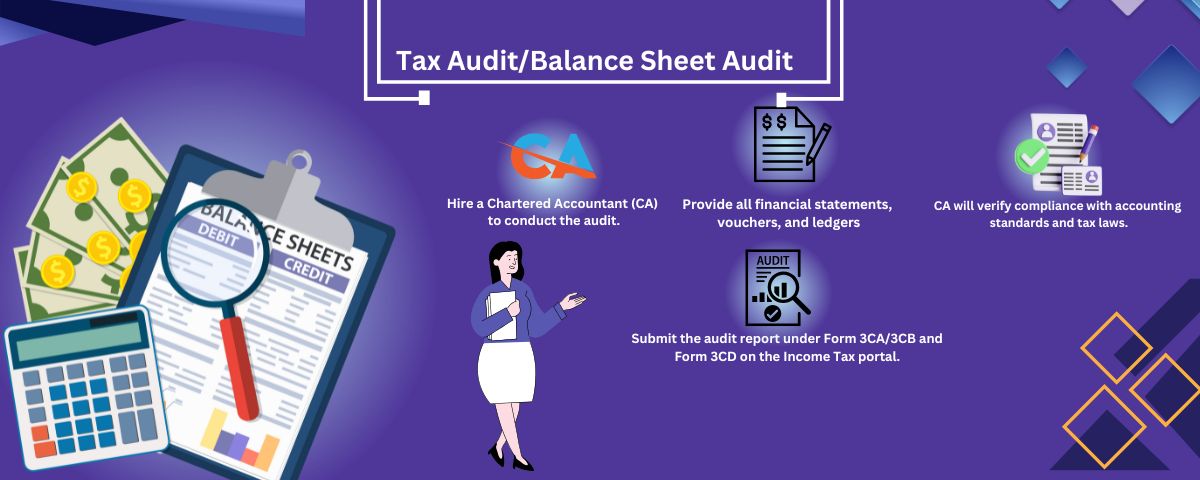

Tax and Balance Sheet Audit

A Tax Audit ensures compliance with tax laws by verifying a business’s financial records, mandated under Section 44AB of the Income Tax Act. A Balance Sheet Audit examines a company’s assets, liabilities, and equity to ensure financial accuracy and transparency. Both audits help in regulatory compliance and fraud prevention.

Required Documents:

- Financial statements (Balance Sheet, P&L Statement).

- Books of accounts and vouchers.

- GST Returns and ITR details.

- Loan statements (if applicable).

Information:

- Mandatory for businesses with turnover above ₹1 crore or professions with receipts above ₹50 lakhs.

- Audit ensures compliance with tax laws.